Basic Tokenomics

Structure of work

Composition of Basic Tokenomics:

01

02

03

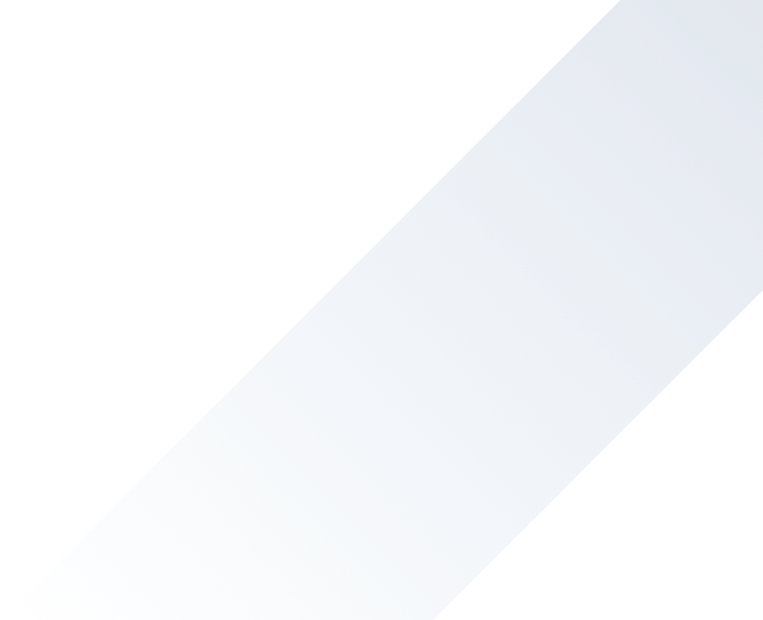

Calculation of the optimal total issue, its type (finite / unlimited), definition of methods of token withdrawal from circulation (if necessary).

Calculating the optimal percentage distribution of tokens across pools, determining the optimal cliff and vesting period for the smooth introduction of tokens into circulation, taking into account the target number of users and their performance.

Diagram of the accumulation of tokens in circulation for a measurable time period (e.g., 3 years).

Workflow:

01

02

03

04

Studying the project, getting input data from the customer on tokenomics (the number of investment rounds, the target volume of attracted investments, methods of incentivization, key financial indicators for CA and the final product, such as the target number of users, the average bill, etc.).

Elaboration of the primary model of basic tokenomics, discussion of the primary model with the customer.

3TGE, volume of users and their behavior on competitors' platforms.

Finalization of the basic tokenomics, taking into account the wishes of the customer

Required Introductions:

Key information about the project (WP / product deck / product description), including the utility token and/or NFT, tools and terms of user incentivizathion, product mechanics tied to the use of the token and/or NFT in the project.

Information on the desired amount of tokens needed for distribution under the project team.

A roadmap describing the process of introducing new tokenization / demand stimulation mechanics and/or NFTs.

Information on the target number of investment rounds, their type (venture rounds, IDO/IEO, retrodrop) and the amount of attracted investments, as well as the target evaluation of the project.

Available project financial targets: target user volume at different stages, target user lifetime on the platform, average receipt and token volume distribution among different user categories (if this information is available).